Individual taxpayers that need additional time to complete their personal tax returns can file Form 4868 on or before their deadline for an automatic extension of up to 6 months.

Generally, the deadline for individuals to file Form 1040 is April 15th.

ExpressExtension, an IRS-authorized e-file provider of IRS Tax Extensions, offers a complete solution for e-filing your Form 4868 securely and accurately.

Express Guarantee

If the IRS rejects your Form 4868 as a duplicate return, we automatically refund your filing fee.

File an Extension in Minutes

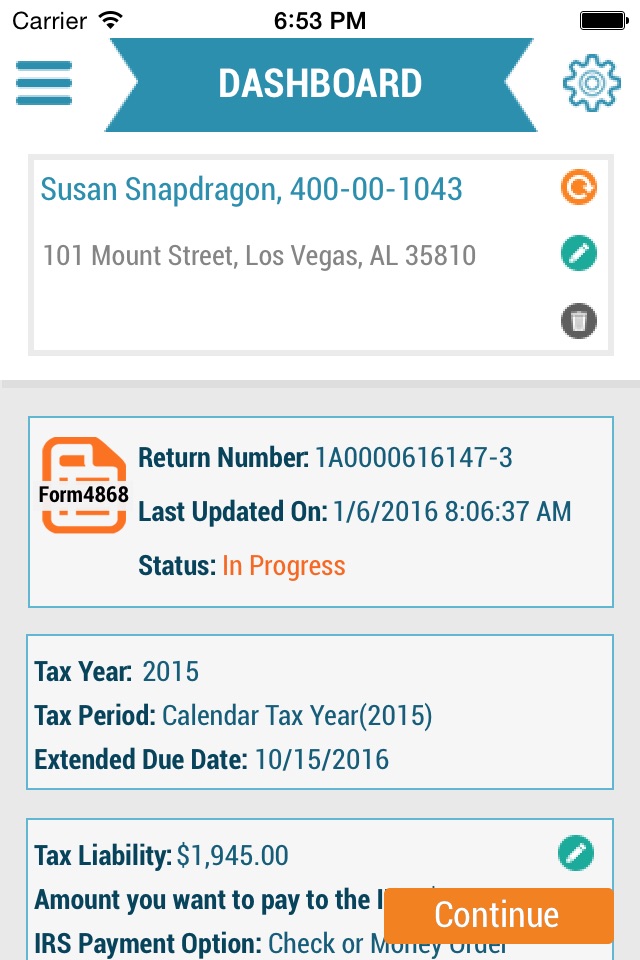

You can file your personal tax extension in a few steps using our app, and we will notify you when the IRS approves your extension.

Option to Pay Taxes Due

You have the option to pay your balance due to the IRS while filing your extension.

Internal Audit Check

Our built-in error checks identify common errors before the form is transmitted to the IRS.

Instant Status Updates

Once your extension is transmitted, you will receive instant email notifications regarding the IRS status of your form.

Retransmit Rejected Returns for Free

If your extension is rejected by the IRS, you can fix the errors and retransmit your form for free.

Follow these steps to e-file Form 4868:

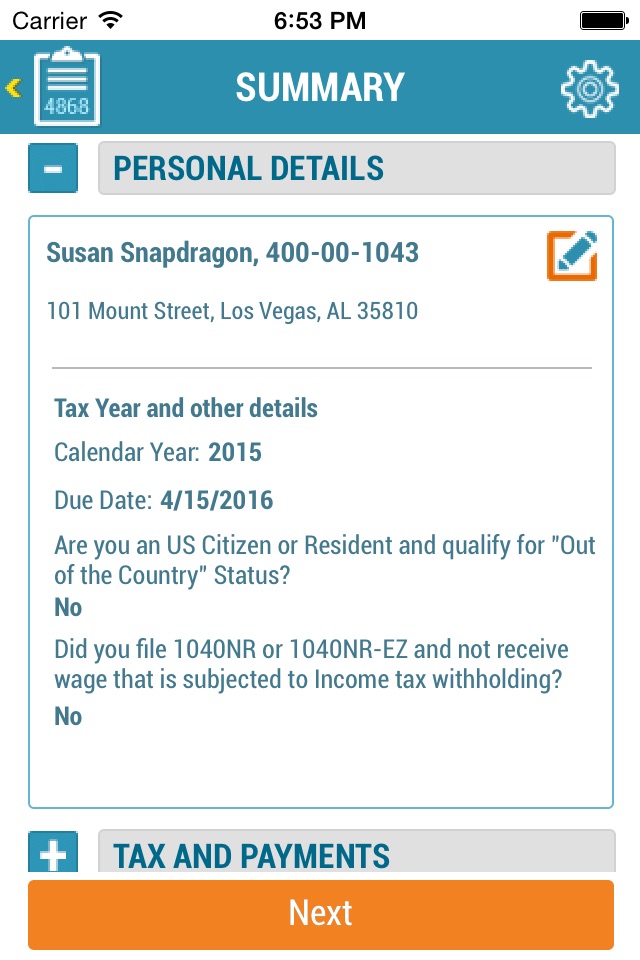

> Download our app and create your ExpressExtension account.

> Select the form you want an extension for and the tax year.

> Enter the required form data and tax balance due (if any)

> Choose a payment method to pay the tax balance due to the IRS (EFW or EFTPS).

> Review the form summary and transmit it to the IRS.

If you have any more questions, you can contact our live support team at (803) 514-5155 or email [email protected].